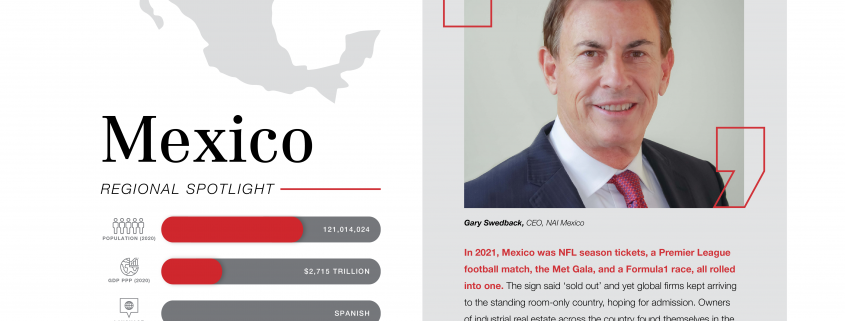

In 2021, Mexico was NFL season tickets, a Premier League football match, the Met Gala, and a Formula1 race, all rolled into one. The sign said ‘sold out’ and yet global firms kept arriving to the standing room-only country, hoping for admission. Owners of industrial real estate across the country found themselves in the right place at the right time. Most major markets saw historically low vacancy rates ranging from .5% to 5%, as a result of strategic perspective shifts from global players.

Despite the pandemic and rising fuel costs, Mexico was almost perfectly positioned for a record spike in demand for industrial real estate. Some markets saw 40-100% increases in leasing while a lack of inventory required many global operators to delay expansion or new entry for 6-12 months. By Q3 2021, most industrial transactions were registered as new build-to-suit construction, to lease or own. This has required longer lease terms,

averaging 7-10 years, at lease rates which escalated 10-20% during the last 18 months.

Medical, aerospace, and automotive sectors initially slowed during 2020, but rebounded by 2021, while logistics and fulfillment sharply escalated. Scores of new fulfillment operations expanded into Mexico, often leasing more than 100,000 square feet. These range from existing firms to new operators from US, Canada and Europe, as well as a large influx of Pacific Rim-based companies entering Mexico to avoid future tariffs and duties, and US firms reshoring from China.

Office and retail sectors have paralleled the US experience during the last 18 months. Construction has slowed, and land-lords are working to retain tenants and rebalance their portfolios.

The unique selling point of Mexico continues: Labor rates are a fraction of the US market, real estate values and prices are still competitive, and the ability to ship overnight to US markets greatly enhances the competitive advantage. Global industrial operators will turn the corner on 2021 and continue the same pace into 2022, as strategic planners in board rooms in Asia, Europe and the US plan further record investment, and leverage Mexico’s continued strategic advantage as a major industrial platform for all of North America.

If you want to consult the full Global Market Trends & Predictions for the Year by NAI Global, Click Here.