As manufacturing in Mexico returns to pre-pandemic levels, several recent legal developments may affect those operations. Manufacturers, particularly those in the automotive industry, need to consider new Mexican labor regulations, the recent interpretation of the United States-Mexico-Canada Agreement´s (USMCA) Automotive Rules of Origin, and new requirements concerning transparency of ownership.

Recovery of Automotive Manufacturing in Mexico

North American manufacturers of sophisticated and highly-regulated products that are to be delivered Just-in-Time, such as automotive or aerospace products, benefit from reliable, close-to-home suppliers.

In the USMCA manufacturing region, Mexico has a number of competitive advantages to manufacture labor intensive and sophisticated products—namely several decades as part of North America’s complex supply chains, significant trade promotion programs, and a large number of Free Trade Agreements to name a few. Such advantages are reinforced through USMCA’s market access certainty to both the U.S. and Canada.

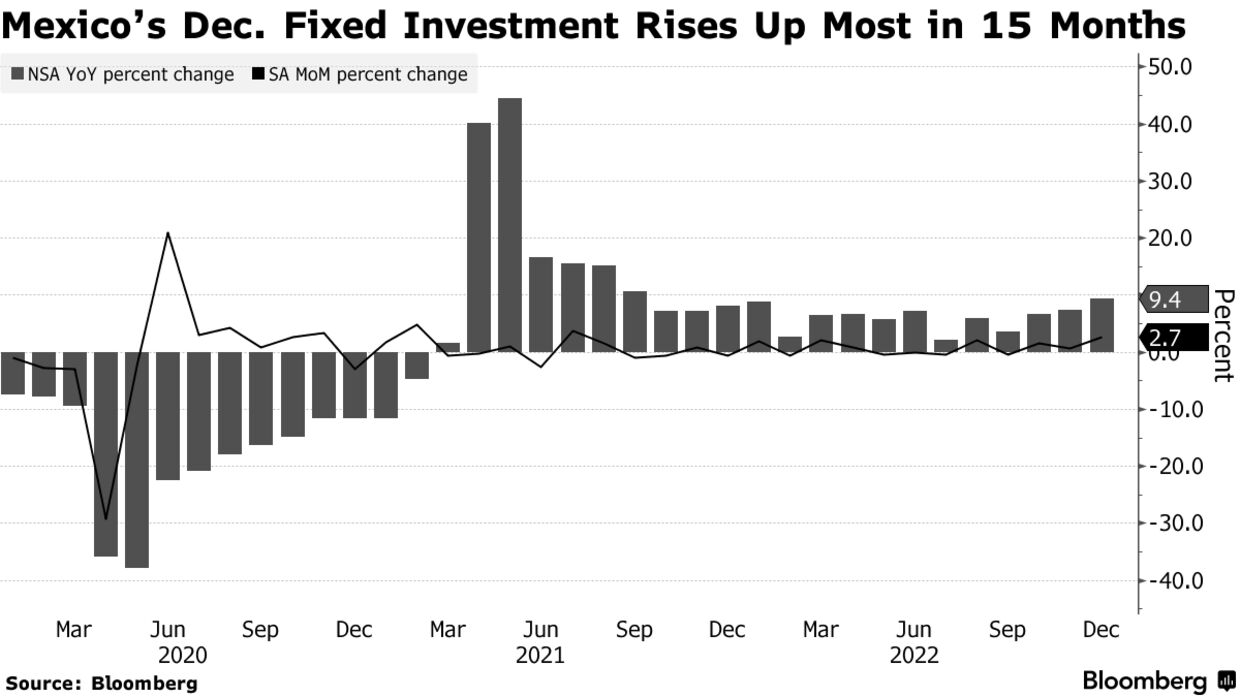

Although Mexico’s economy faced extreme difficulties due to the COVID-19 pandemic as there was no governmental program to boost its economy, the country’s resilient manufacturing sector already has surpassed pre-pandemic levels. This boost in manufacturing can be partially attributed to nearshoring of manufacturers into Mexico—many in the automotive industry—in order to be closer to the U.S. and Canada markets. This nearshoring trend has triggered the arrival of new foreign direct investment (FDI).

The Mexican Ministry of Economy recently reported that Mexico captured US$35.29 billion in FDI during 2022, up from $31.54 billion in 2021. Manufacturing reigns as the most influential sector in that increase, accounting for 36% of the country’s total FDI, with the U.S. and Canada standing out as Mexico’s two main trading partners. The Ministry of Economy also noted that automotive part manufacturers were among the largest recipients of foreign investment.1

According to 2022 data, the FDI in the automotive manufacturing sector has not yet recovered to pre-pandemic levels. However, there are reasons to be optimistic that this will change in the near future due to the USMCA’s market attractiveness and the natural advantages of manufacturing in Mexico, such as its highly specialized labor force and its geographic proximity to the U.S.

In anticipation of Mexico’s continued growth as a manufacturing hub for U.S. automotive companies, the following are recent updates and trends in Mexico that your company needs to consider when relocating or operating in the country.

Increase of Labor Benefits

The Lopez-Obrador administration has pushed for increasing labor benefits to employees in Mexico, which investors in Mexican manufacturing should take into account when making their budgets and economic projections. The following are the most recent and relevant changes to existing labor rules:

Vacations

Effective January 1, 2023, the Federal Labor Law increased vacation days in Mexico. Before this amendment, employees had a minimum of six (6) working days’ vacation period per year of service. The new rule increases the period to a minimum of twelve (12) working days per year of service, which will grow by two (2) days per year up until the employee is entitled to twenty (20) working days vacations. As from the sixth year of service, the period shall increase by two (2) working days per every five (5) years of service.

Minimum Wage

Beginning January 1, 2023, the minimum wage for Mexican employees increased 20%. Even though most employees receive more than minimum wage as a starting salary, this increase is expected to impact even Mexican companies that pay above minimum wage, as they commonly index salaries to a minimum wage reference. The effect of rising minimum wage on salaries will become clearer when the common yearly salary revision takes place.

Pension Funds

According to a 2020 amendment to the Mexican Social Security Law, companies’ mandatory contributions to one of the components of employees’ pension funds shall progressively increase from the current 3.15% of the employee salary to 11.87%. This increase shall occur progressively from 2023 up until 2030; during 2023, employers’ contribution will range from 3.15% to 4.24%, depending on the employee’s salary.

Mandatory Legitimization of Collective Labor Contracts

May 1, 2023 is the maturity date for all existing collective bargaining agreements across Mexico to be legitimized through the express support of a majority of the workers covered by the relevant agreement (following a carefully staged process). Legitimization efforts have long been underway as per the relevant rules issued May 1, 2019. However, it is expected that 80% to 90% of current collective labor contracts will not meet the legitimization threshold and, consequently, will be automatically terminated.

When such agreements are terminated, individual labor contracts will be automatically created for every worker; said individual contracts will incorporate the terms contained in the then-terminated collective labor contracts that are superior to the minimum standards established by Mexican laws.2 This measure intended for individual workers to continue under the same labor conditions, though no longer under a collective labor contract.

The lack of a collective labor agreement—the long standing status quo in the country—likely will bring restlessness in the workforce. Though workers’ current rights will be preserved by the individual labor contracts, Mexican workers will need to decide whether to enter into a new collective labor agreement sooner rather than later.

Source: The National Law Review