Original post by The Canadian Press.

WASHINGTON – In a bid to counter China’s growing geopolitical influence, a bipartisan team of U.S. senators is spearheading efforts to broaden the scope of the acclaimed U.S.-Mexico-Canada Agreement (USMCA) to include select Latin American nations.

Expanding the USMCA: A Bipartisan Effort.

Earlier this year, Senator Bill Cassidy of Louisiana enlisted the support of his Democratic counterpart, Senator Michael Bennet of Colorado, to jointly introduce the Americas Trade and Investment Act.

This legislation aims to expand the USMCA, often referred to as CUSMA in Canada, to forge a more robust economic alliance.

Benefits of Investing in Neighbors.

“From a U.S. perspective, investing in our neighbors provides a higher return on foreign expenditure compared to overseas investments,” Senator Cassidy emphasized during a USMCA panel discussion. “As Mexico prospers, so does the United States, and vice versa. That’s the beauty of capitalism – it’s a win-win for everyone. That’s precisely what I’m striving for – a victory for all.”

The Council of the Americas Report.

The recent launch of a new report by the Council of the Americas, which delves into the concept of “accession” to the USMCA, underscores the importance of reinforcing economic strength throughout the Western Hemisphere.

White House’s Commitment to Hemispheric Trade.

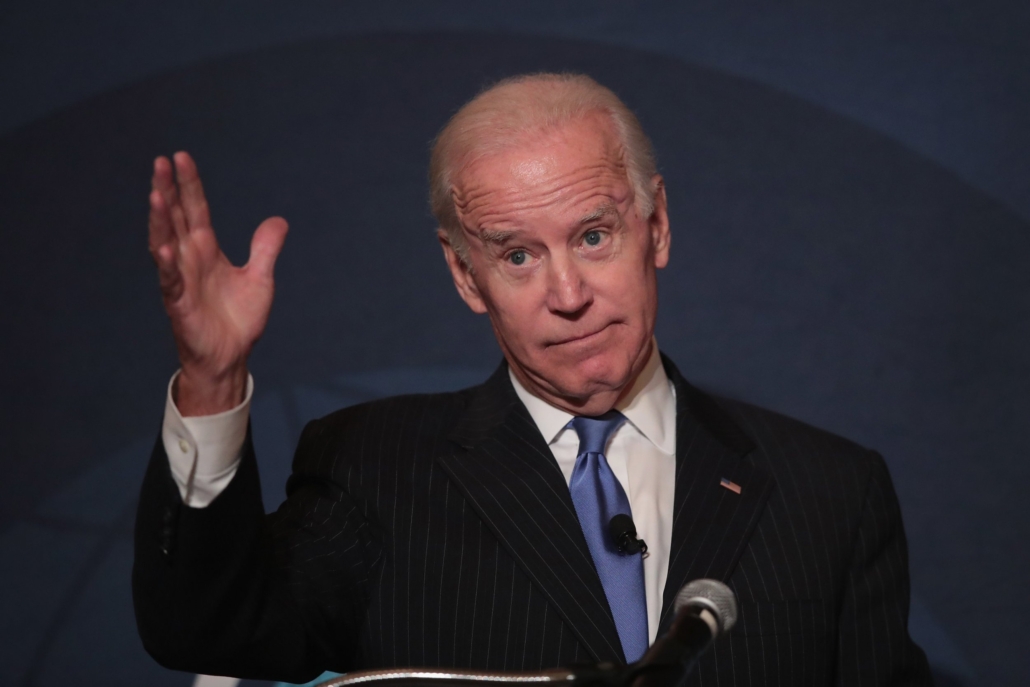

This notion of hemispheric trade has not escaped the notice of the White House. During last year’s Summit of the Americas, President Joe Biden introduced the Americas Partnership for Economic Prosperity, one of several trade “frameworks” designed to enhance economic and geopolitical bonds among key U.S. allies.

A Pragmatic Approach: “Docking” Partners into USMCA.

The report advocates for “docking” current or future U.S. trading partners into the USMCA as a more pragmatic and effective approach to bolstering regional integration.

The success of the USMCA.

Juan Carlos Baker, one of the report’s co-authors and a lead negotiator for Mexico during the NAFTA talks that led to the USMCA’s creation in 2018, hailed the agreement as a resounding success for all three countries.

He stated, “Canada and Mexico are now the preferred partners of the United States, and vice versa. Given the high levels of uncertainty and volatility globally, aligning potential allies around shared values and objectives is a sensible approach for North American countries.”

Challenges of Reopening the Agreement.

However, former diplomat Louise Blais, an advisor for the Business Council of Canada, cautioned that reopening this hard-won agreement may face resistance due to political uncertainties and volatility.

She noted, “There is no consensus in the U.S. government on this issue. I would not even qualify this discussion as having hit Main Street, despite Sen. Cassidy’s efforts.”

Mandated Review in 2026.

The USMCA mandates a review involving all three parties in 2026, with a requirement to maintain the agreement. Most Canadian advocates prioritize successfully navigating this process.

Canada’s Stance.

While the Council of the Americas champions trade and investment across the Americas, Blais emphasized that the immediate priority should be renewal, not amendment.

Canada’s International Trade Minister, Mary Ng, has been actively advocating for prompt trilateral endorsement, reiterating that the current agreement lacks mechanisms to allow new countries to join.

Potential Latin American Candidates.

The report does not delve into the specific Latin American countries that should be invited to join the USMCA, but there are evident candidates with robust trade connections to the U.S. These candidates include Barbados, the Dominican Republic, Chile, Colombia, Panama, Peru, Uruguay, Ecuador, and Costa Rica, which has outgrown its existing Central American trade agreement with the U.S.

Costa Rica’s Aspiration.

Costa Rica’s Minister of Foreign Trade, Manuel Tovar Rivera, highlighted the nation’s burgeoning medical devices and semiconductor industries, as well as growth in aerospace and automotive sectors, areas of particular interest to North America.

He stressed that Costa Rica is a different country with different challenges and aspirations.

A Strong Message on Labor and Environmental Standards.

Furthermore, accession to the USMCA would signal the importance of strengthening labor and environmental standards, offering a potential reward to countries seeking reform.

However, these proposals come at a politically sensitive moment in the U.S., with former President Donald Trump leading the race for the Republican nomination in 2024. Additionally, Mexicans are preparing for upcoming elections, while Canada faces a federal election within the following year.

Considering Domestic Politics

The report acknowledged these political complexities, stating, “Expanding the USMCA will demand an articulated strategy that considers the domestic political situation in Mexico, the United States, and Canada, since the three countries will have general elections in 2024 and 2025.”

*This article by The Canadian Press was first published on September 14, 2023.* All Information presented here, was redacted by NAI Mexico’s Corporate Communications Team, based on the original article published by “The Canadian Press”.