The Evolving Global Political-Economic Landscape with Nearshoring Opportunities.

In a rapidly evolving global landscape, manufacturing industries face a multitude of challenges and opportunities. “Geopolitical shifts, supply chain dynamics, and economic uncertainties have prompted companies to rethink how they approach production, competitiveness, and nearshoring. In this article, we delve into the insights provided by Boston Consulting Group (BCG) to navigate this complex terrain successfully.

This article explores a strategic framework comprising five pivotal steps that empower businesses to adapt to these transformative forces. We offer actionable strategies for thriving amid change, including clear strategy, visibility, cost assessment, informed nearshoring, and governance. Join us on this journey as we unveil the keys to staying agile and competitive in today’s dynamic manufacturing environment.

Trade Wars, the Pandemic, and Geopolitical Tensions.

The international political-economic system has been prominently featured over the past five years due to various tensions that have arisen within it, such as trade wars, the pandemic, and even geopolitical tensions, all of which impact nearshoring decisions. Collectively, these factors have exacerbated supply chain issues, creating logistical bottlenecks. This, in turn, has necessitated a global-level reconfiguration of where companies manufacture and source their products.

The Rise of New Manufacturing Powers and Nearshoring Opportunities.

A report published on September 21, 2023, by Boston Consulting Group (BCG) titled “Harnessing the Tectonic Shifts in Global Manufacturing” helps shed light on the magnitude of this issue and the resulting changes.

BCG released information estimating that over 90% of manufacturing companies in North America have successfully relocated or are in the process of relocating their production facilities to various countries. It’s worth noting that this 90% encompasses only the companies surveyed by BCG.

Potential for Development as Emerging Powers and Nearshoring Choices.

According to BCG, the primary factors driving these changes in the production processes of North American companies can be attributed to three key phenomena in the international system, one of which is the nearshoring option.

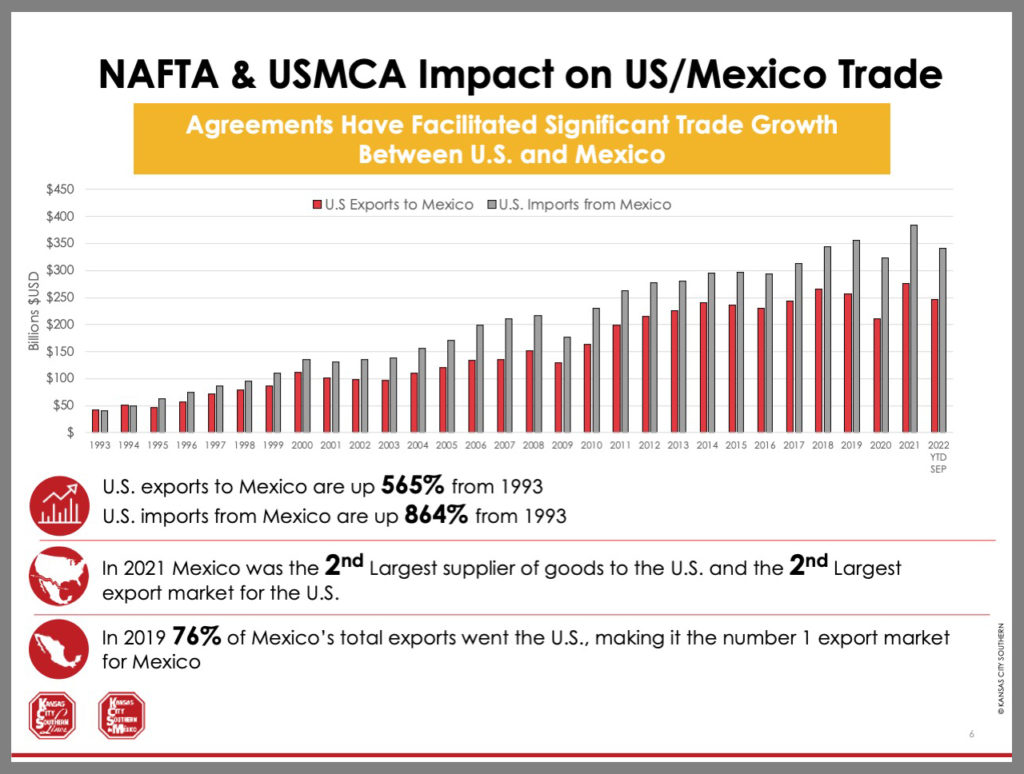

- The uncertainty in the international geopolitical system: This phenomenon is primarily driven by tariff costs imposed by the United States of America (USA). These tariffs have undermined confidence in China as the primary export platform for several American industries.

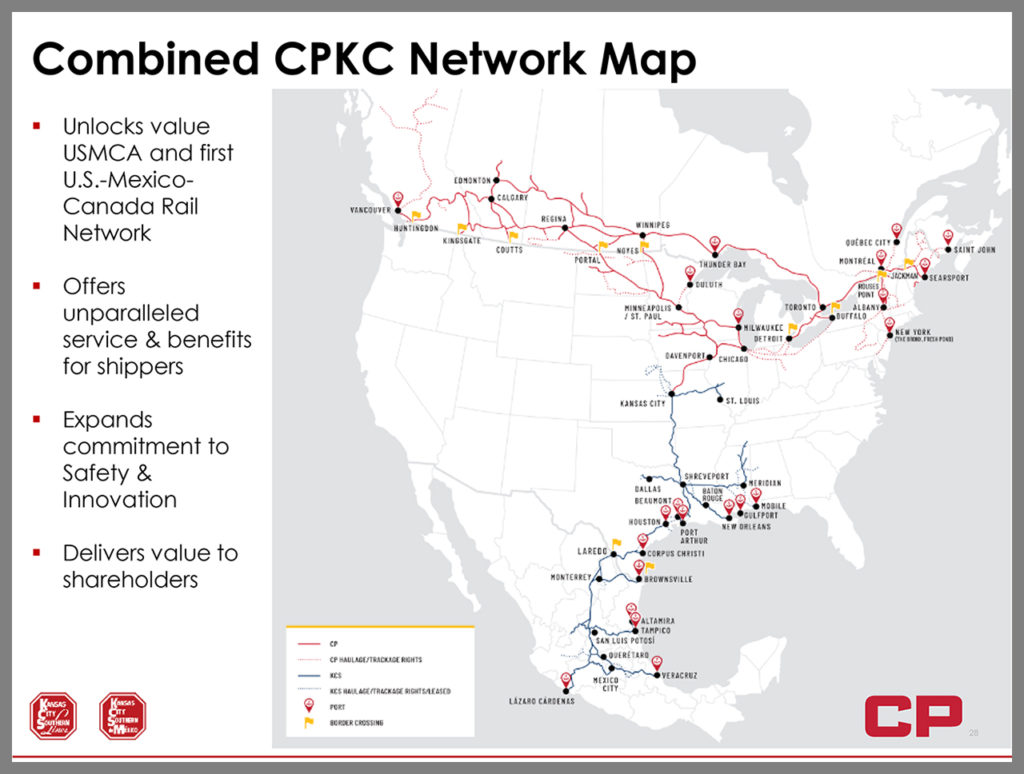

- The rise of Mexico, Southeast Asia, and India: This triad has garnered attention for its competitive production costs, abundant labor availability, and substantial development potential across various industries. Thanks to these attributes, they are widely regarded as the next manufacturing powerhouses.

- Morocco and Turkey: The aforementioned duo had a substantial expansion capacity in their manufacturing processes due to their proximity to the European Union (EU). However, their advantages don’t stop with the EU; their geographical positions also grant them excellent access to other markets. This advantage translates into competitive production costs when compared to the Chinese market. Crucially, these changes are being driven by the United States in response to a growing demand for local production.

Impact of Wage Inflation on Global Competitiveness and Nearshoring Considerations.

As previously noted, recent changes have influenced the global market and manufacturing companies into a trade-off to maintain competitiveness. It’s important to emphasize that these considerations are specifically tied to nearshoring. In this context, wage inflation has become a direct negative factor for manufacturing companies. While this may benefit the average worker, who has no concerns about this phenomenon as it increases their purchasing power, on a global scale, it translates into overall inflation. This is because the cost of living and purchasing power show significant disparities due to the increase in costs for the end consumer.

The BCG report indicates that wage inflation has outpaced production gains in most regions. This is evident in a 21% increase in labor costs in the USA between 2018 and 2021, and a 24% increase in China during the same period. Similarly, Mexico experienced a 22% increase, while India saw an 18% increase. However, these increases do not rule them out as highly competitive manufacturing markets at present. Therefore, these two markets are solid options when it comes to discussing Nearshoring.

Market-Back Approach and Integrated Marketing Communication (IMC).

In order to achieve better outcomes, BCG recommends in its report that North American companies adopt a “market-back” approach. In other words, companies should seek their own mechanisms to establish and design a coordinated marketing process to increase their chances of success, considering that Integrated Marketing Communication (IMC) programs play a crucial role in this endeavor.

BCG’s Recommendations for Addressing Changes with Nearshoring in Mind.

To be effective, this process should commence with structuring it based on the end market. Subsequently, design a comprehensive manufacturing process, manufacturing footprints, and supply networks. This may allow to include of nearshoring options. In fact, this report makes it clear that there is a complete 5-step process to reach such an approach.

Step 1: “Establish a Clear Strategy for Nearshoring Success.”

The first step involves creating a manufacturing footprint. This involves considering the company’s starting point and the challenges faced by project leaders, including those related to nearshoring. Recognizing that this challenge arises naturally due to no market having all necessary factors to fully meet production demands is crucial. Thus, making early-stage adjustments to the production footprint can mitigate and resolve issues, while also optimizing available supply networks.

Step 2: “Creating End-to-End Visibility.”

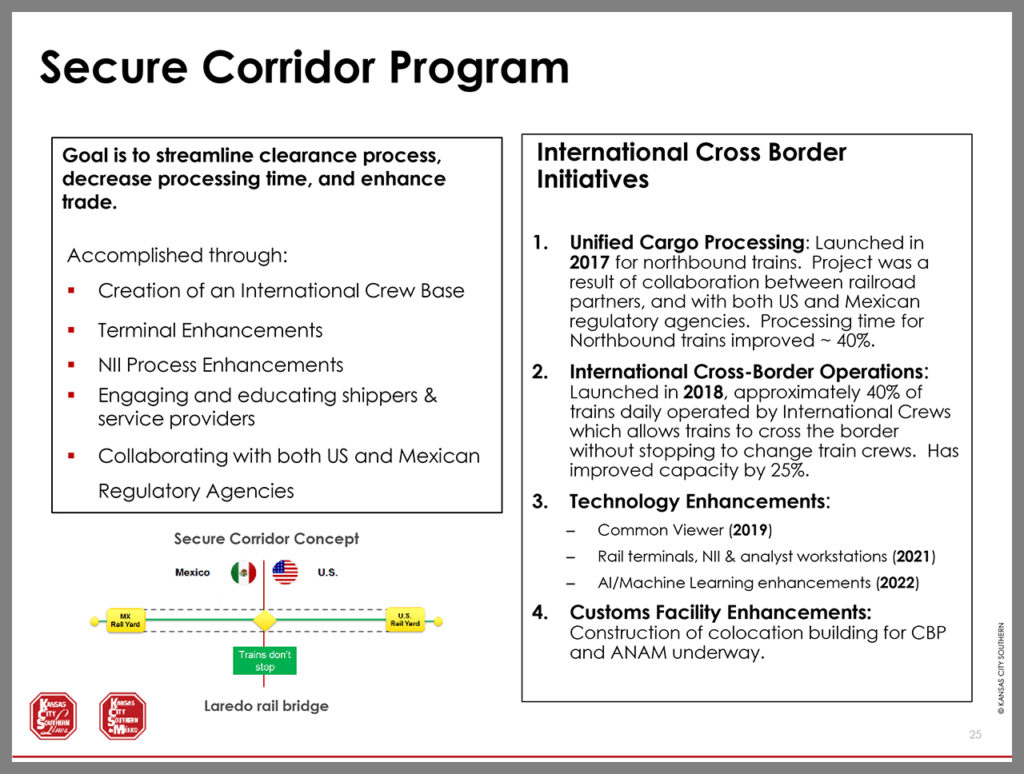

The first step is to establish “end-to-end visibility,” including visibility into nearshoring decisions. This capability involves tracking and monitoring products and components throughout the supply chain, from acquisition to customer delivery. Indeed, meticulous tracking of each process stage, capturing all relevant data, and centralizing it in a data management system are essential.

This enables continuous review, analysis, and extraction of valuable insights to enhance business processes, support long-term financial planning, and inform strategic decision-making, including nearshoring choices.

Additionally, this visibility leads to improvements in six key supply chain areas:

- Procurement and Inventory Management.

- Finance.

- Logistics.

- Operations.

- Quality Control.

- Sales and Customer Service.

Step 3: “Assessing Landed Costs.”

This calculation encompasses all costs related to shipping each item, including the initial product price, shipping or transportation expenses, taxes, tariffs, customs clearance, insurance, packaging fees, handling fees, and even currency exchange rates.

Step 4: “Consideration of Trade-offs and Compromises in Location Decisions.”

Equally important is considering “trade-offs” and the risks linked to location choices when setting up operations in a specific region or market. Considering production and delivery capacity, as well as evaluating the necessary capital investment and staff training to meet the demand, becomes essential when choosing a specific location.

Step 5: “The Importance of a Clear Governance Structure.”

Finally, it is crucial to have a clear governance structure. The governance structure refers to how an organization is designed and organized to make decisions and exercise control. Then include a well-structured operating model, taking into account nearshoring considerations.

Success heavily relies on the governance structure in use, allowing the leadership team to maintain a comprehensive perspective and framework for long-term success. When executed correctly, nearshoring initiatives can indeed thrive.

Final Thoughts on Navigating the Dynamic Manufacturing Landscape with Nearshoring Strategies.

In the ever-changing global manufacturing landscape, these strategic insights offer a valuable roadmap for businesses, including those considering nearshoring. This article covers strategy, nearshoring decisions, and governance structures, explaining key factors and providing actionable steps for successful navigation.

Furthermore, to stay at the forefront of industrial real estate market trends, make sure you don’t miss the quarterly research reports that NAI Mexico generates. These reports are a valuable resource for staying informed and maintaining a competitive edge in this evolving industry. Stay agile and continue to embrace transformation within the manufacturing sector.